We compared the 3 best TrustLayer Alternatives - Here's Our Feedback

Discover the top 3 TrustLayer alternatives for certificate of insurance tracking. Compare Certificial's real-time policy monitoring, Ebix's enterprise scale, and MyCOI's affordable automation to find which platform delivers better fraud prevention and compliance rates for your risk management needs

If your company tracks third-party certificates of insurance (COIs), you are probably familiar with Trustlayer. This COI tracking tool automates certificate collection and (according to their website) offers access to 298,000+ companies, which explains its popularity among procurement and risk teams.

However, TrustLayer has several limitations that can create gaps in your insurance risk management:

- No real-time policy monitoring: TrustLayer cannot detect when Vendors' policies are cancelled mid-term, when coverage limits get reduced, or when endorsements change after initial submission

- Unclear fraud detection methodology: TrustLayer claims "AI/ML-powered verification" but provides no transparency on whether it verifies directly with carriers or simply analyzes PDFs

- No schedule-level verification: You cannot confirm if specific vehicles (VINs), equipment (serial numbers), or locations are actually covered on policies

These gaps mean you're managing compliance with snapshots that may not reflect actual coverage today, creating exposure to uninsured Vendor incidents. This is why you might want to evaluate TrustLayer alternatives that offer real-time policy monitoring and direct carrier verification.

We researched three alternatives by speaking with actual customers and analyzing product reviews: Certificial, Ebix, and MyCOI. This guide will help you assess which platform addresses TrustLayer's limitations for your specific risk profile and compliance requirements.

First, we'll review the most common problems users face with TrustLayer.

What's Wrong with TrustLayer - Why Companies Are Looking for Alternatives

The most critical limitations of TrustLayer all have to do with inability to answer the question: is my Vendor's coverage actually valid and fully compliant right now?

Unclear Fraud Detection Methodology

TrustLayer claims "AI/ML-powered certificate analysis and fraud detection" but provides no public details on how it actually works. Does it verify directly with carriers, analyze PDF forensics, or use third-party data sources?

Without source verification or carrier connections, "AI detection" likely means PDF analysis, which sophisticated fraud can easily bypass. Unless TrustLayer verifies directly with Insurance Agents or connects to carrier systems, a Vendor with basic Photoshop skills can create a convincing fake certificate that passes automated checks.

No Real-Time Policy Monitoring

The fundamental problem is that certificates that risk teams accept in TrustLayer show coverage status at submission date only. It cannot detect when Vendors' policies are cancelled mid-term, track coverage limit reductions.

If a policy changes the next day, TrustLayer won't reflect it until the next renewal cycle - potentially 12 months later.

No Schedule-Level Data Tracking

TrustLayer cannot verify if specific vehicles (VINs), equipment (serial numbers), or locations are covered on policies. Generic coverage confirmation is insufficient for transportation, construction, and logistics industries where assets change constantly.

Just because a Vendor has Auto Liability doesn't mean the specific truck arriving at your jobsite is on the policy.

Why do Smart COIs matter?

Traditional COIs are static PDF documents that are valid only on their generation date. A certificate showing coverage through December becomes meaningless if the carrier cancels the policy in March - and you won't know until you manually call your Vendors for verification (which will waste a lot of your team's time).

Smart COIs connect directly to agency management systems (AMS) and update automatically when policies change.

Because of this, SmartCOIs can capture:

- mid-term cancellations,

- limit reductions,

- schedule-level insurance data changes (e.g. vehicle removed from Auto) within minutes of the Agent's update.

This technology is only available through platforms with direct AMS integrations. Certificial is currently the only COI tracking platform offering this capability.

TrustLayer Alternative #1 - Certificial (The Only Platform with Real-time Policy Monitoring)

.png)

Certificial is solving two common challenges in certificate of insurance management:

- certificates that quickly become outdated after issuance,

- difficulty of verifying document authenticity when certificates are self-submitted by Vendors.

Certificial primarily works with mid-to-large enterprises in construction, manufacturing, transportation, and property management - industries where managing Vendor insurance documentation at scale is operationally complex.

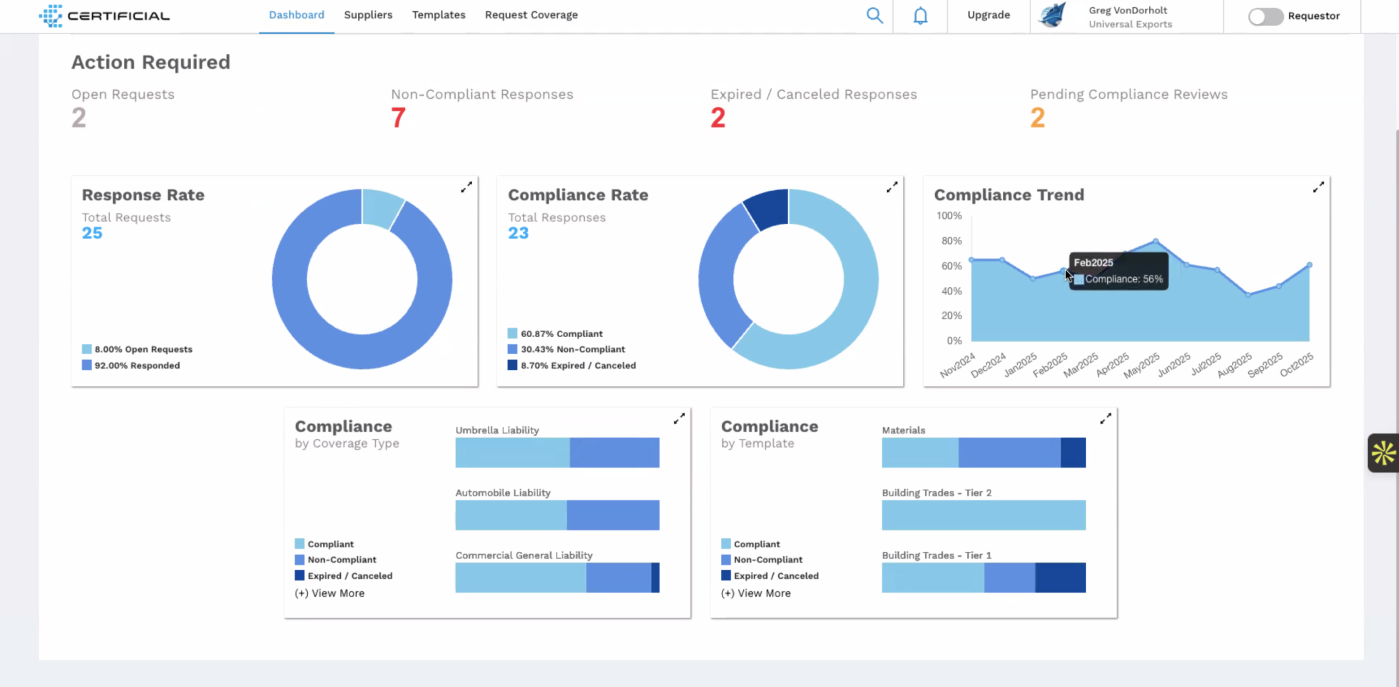

Certificial Overview

Certificial combines COI tracking for certificate requestors (you) with a COI issuing platform for Insurance Agents and Brokers. This connects Vendors' insurance Agents directly with you, eliminating the need for verification.

This means that Certificial connects directly to Agent Management Systems (AMS) like Applied Epic and major agency systems, capturing policy changes - cancellations, limit reductions, or schedule modifications.

For example, when an Agent cancels a policy on Tuesday morning, your Certificial account shows "Cancelled" status within minutes.

This real-time monitoring happens through a network of 12,000+ insurance agencies representing over 90% of commercial insurance in North America.

When a Vendor removes equipment from its policy schedule to reduce costs, the change takes effect immediately.

Certificial's customers report 90%+ compliance rates compared to the 60-70% industry average.

For example, PowerFlex increased compliance from 67% to 90%+ in three months while saving 2-3+ hours per week on manual Vendor follow-up. Another transportation client improved compliance from 82% to 98%+ and reassigned 3-5 full-time employees per distribution center to other tasks.

Certificial vs TrustLayer Comparison (in-depth comparison)

Certificial and TrustLayer take fundamentally different approaches to verification, which directly determines whether you catch policy changes before they create risk.

Where Certificial has clear advantages over TrustLayer:

- Only platform with patented Smart COI technology providing real-time policy monitoring

- 100% fraud elimination through source verification architecture - Vendors cannot submit documents

- Schedule-level verification for specific vehicles, equipment, and locations

- 90%+ compliance rates versus TrustLayer's estimated 65-75%

- Automatic renewal updates when Agents renew policies, eliminating the need to chase Vendors during January renewal season

- ACORD partnership positioning Smart COIs as the future industry standard

- Protection against mid-term cancellations and limit reductions that TrustLayer can't detect

Where TrustLayer may have advantages:

- 298K+ company network may speed onboarding if Vendors are already in their system

- Industry benchmarking feature to compare compliance rates against peers

- No-vendor-login requirement for simplified Vendor experience

Certificial Pricing

Certificial offers a free plan for organizations tracking up to 5 Vendors/Suppliers, making it accessible for small teams to test the platform. For companies managing more than 5 Vendors, pricing is custom and based on Vendor volume and required features.

Certificial is positioned as moderately priced ($) compared to enterprise platforms like Ebix ($$), and uses similar pricing to TrustLayer's mid-range custom model.

The key difference is that Certificial delivers measurably better compliance outcomes (90%+ versus 65-75%) and superior fraud protection at a comparable price point.

Book a free demo of Certificial to see how it can help you reach a 90%+ compliance rate.

TrustLayer Alternative #2 - Ebix (Enterprise Scale with Complexity Tradeoffs)

Worth noting upfront: Ebix filed for bankruptcy in 2023, though it emerged under new ownership and continues operating. If you're evaluating long-term partnerships, that financial instability deserves consideration.

Ebix Overview

Ebix targets Fortune 500 companies managing thousands of Vendors across global operations and multiple subsidiaries.

COI tracking isn't a standalone product; it's a certificate management module within their broader insurance technology ecosystem. If you need just COI tracking, then Ebix might not be the right fit for you.

The system handles core workflows:

- Automated collection from Vendors and Subcontractors (not Agents),

- Centralized certificate storage,

- Compliance monitoring against configured requirements,

- Automated renewal reminders,

- Multi-entity management for complex corporate structures.

You can customize compliance requirements across business units, geographies, and Vendor categories with the flexibility to map intricate regulatory jurisdictions.

Security includes SOC 2 Type II certification, role-based access controls, and audit trails. But that security protects data storage and transmission - it doesn't verify certificate authenticity.

Ebix accepts uploaded PDFs at face value, with no forensic analysis, Agent verification, or fraud-detection algorithms.

Like TrustLayer, it relies on static documents that become outdated the moment a carrier makes policy changes.

However, there are a couple of advantages for enterprise buyers:

- Proven scalability for high-volume certificate management,

- Direct connections to carriers and brokers through Ebix's established exchange network for document sharing (not real-time verification),

- Deep customization for sophisticated compliance frameworks.

Organizations already using Ebix for insurance distribution or broker operations can benefit from unified data management.

With all of this in mind, Ebix's limitations are predictable:

- Overly complex for mid-market companies with straightforward needs

- No Smart COI technology or real-time policy monitoring

- Limited fraud prevention that misses sophisticated forgeries

- Dated interface reflecting early 2000s design patterns,

- Slow implementation timeline (may take weeks or even months)

Ebix vs TrustLayer Comparison

Both platforms rely on static PDFs and lack Smart COI technology or source verification, so neither can detect mid-term policy changes, cancellations, or fraudulent certificates.

Estimated compliance rates hover around 65-75% for both - better than manual tracking but far below the 90%+ possible with real-time monitoring.

Go with Ebix as your TrustLayer alternative if:

- You're already using Ebix for insurance distribution or exchange services

- You need multi-entity management across dozens of subsidiaries

- You require extensive customization for regulatory jurisdictions, or

- You're managing enterprise volume (thousands of Vendors) where TrustLayer's scalability remains unproven.

When TrustLayer makes sense over Ebix:

- You're a mid-market company without enterprise complexity needs

- You want modern interface and Vendor collaboration features

- You need faster deployment (days vs weeks), or

- You prioritize user experience over comprehensive enterprise features.

Ebix Pricing

Ebix doesn't publish transparent pricing - everything is quote-based. Annual costs typically start in the mid-five figures for basic deployments. Comprehensive implementations with multiple modules and integrations can reach six figures annually, with separate charges for implementation fees, annual licensing, and support packages.

TrustLayer Alternative #3 - MyCOI (Affordable Mid-Market Option)

MyCOI targets growing companies with 100-500 employees managing 25-100 Vendors who need to move beyond spreadsheets but can't justify enterprise-level pricing.

The platform focuses on automating routine tasks without the complexity (or capabilities) of more sophisticated alternatives.

MyCOI Overview

MyCOI delivers straightforward certificate tracking automation focused on the basics.

The platform handles:

- Automated Vendor outreach and follow-ups

- A Vendor self-service portal where contractors upload certificates directly

- A centralized repository that replaces email attachments and shared drives

- Expiration alerts before certificates lapse

- Requirement templates for common scenarios

The interface is clean and requires minimal training, which matters for teams without dedicated compliance roles.

Setup takes less time compared to complex platforms like Ebix or even TrustLayer.

Vendor self-service reduces manual data entry by shifting upload responsibility to your contractors.

The trade-off: MyCOI offers basic automation with no Smart COI technology, no source verification, and no fraud-detection capabilities.

MyCOI accepts Vendor-submitted PDFs at face value. If a vendor submits a valid certificate in January and their policy is cancelled in March, it will continue to show compliant status until the expiration date in December.

You won't know coverage disappeared nine months ago until you manually request renewal.

MyCOI vs TrustLayer Comparison

Both platforms lack Smart COI technology and real-time policy monitoring, but they differ in pricing, Vendor networks, and user experience.

When MyCOI makes sense over TrustLayer:

- Budget constraints prioritize affordability over advanced features

- You're managing under 100 Vendors with straightforward compliance requirements

- You have low-risk Vendor relationships without significant fraud concerns

- You don't need the enterprise-level capabilities TrustLayer offers.

When TrustLayer makes sense over MyCOI:

- You can justify a higher investment for better Vendor collaboration features

- TrustLayer's 298K+ company network provides value if your Vendors are already in the system

- Modern interface and user experience are important to team adoption

- You're managing 100+ Vendors, and MyCOI's scalability is a constraint.

Neither platform is recommended if:

- Fraud prevention is your top priority (both lack source verification)

- You need real-time policy monitoring to catch mid-term cancellations

- You require schedule-level data tracking for vehicles, equipment, or locations

- You want proven 90%+ compliance rates instead of the 60-75% range both platforms deliver.

MyCOI Pricing

MyCOI uses tiered pricing starting around $200-400/month for smaller plans, with per-vendor or per-user pricing models depending on your needs. You're paying significantly less than TrustLayer or enterprise platforms, but receiving limited functionality in return.

There's no Smart COI technology, no fraud protection, and no real-time monitoring.

You've seen the features, fraud protection capabilities, and pricing models. Now comes the decision that actually matters: which platform matches your risk tolerance and compliance requirements?

Final Comparison - Which TrustLayer Alternative is Right for You?

Let's compare all TrustLayer alternatives side-by-side:

Choose Certificial as a TrustLayer alternative if:

- Fraud prevention and risk reduction are top priorities, with source verification eliminating 100% of Vendor-submitted forgeries.

- You need real-time policy monitoring to catch mid-term cancellations within seconds (not days or weeks later)

- Require schedule-level verification for specific vehicles (VINs), equipment (serial numbers), or locations.

- Proven compliance outcomes matter - 90%+ rates versus TrustLayer's estimated 65-75%.

- You operate in construction, manufacturing, transportation, or logistics with significant insurance requirements where a single uninsured incident could cost $500K+, making fraud prevention and real-time monitoring mandatory.

- ACORD partnership positioning Smart COIs as the future industry standard matters for long-term compliance strategy.

Book a free demo with Certificial team to see how to achieve 90%+ compliance rate

Choose Ebix over TrustLayer if:

- You're a Fortune 500 enterprise with global operations already using Ebix for broader insurance management.

- You need multi-entity management across dozens of subsidiaries with complex regulatory requirements

- You're managing thousands of Vendors where TrustLayer's scalability remains unproven.

- Enterprise-grade infrastructure and extensive customization outweigh user experience concerns.

Note: Ebix and MyCOI both lack Smart COI technology and real-time monitoring - neither eliminates verification gaps that create mid-term policy lapse exposure.

Choose MyCOI over TrustLayer if:

- You're low on budget, since MyCOI is the most cost-effective TrustLayer alternative ($200-400/month versus TrustLayer's higher custom pricing).

- You're managing under 100 Vendors with straightforward, low-risk compliance needs where basic automation (collection, expiration tracking) meets requirements without advanced features.

- You're comfortable with 60-70% compliance rates and the exposure that creates.

Note: MyCOI has even less fraud protection than TrustLayer - only suitable for low-risk scenarios where Vendor insurance fraud consequences are minimal.

Stick with TrustLayer (despite limitations) if:

- Modern interface and Vendor collaboration features are critical to team adoption.

- The 298K+ company network provides value because Vendors already in their system speed onboarding.

- Industry benchmarking features to compare compliance rates are important for reporting.

- You can accept mid-range fraud protection and 65-75% compliance rates, and your budget doesn't support Certificial but you need more features than MyCOI offers.

The critical question is are you tracking certificates or managing insurance risk?

TrustLayer, Ebix, and MyCOI track certificates, confirming that a PDF exists in your files. Only Certificial monitors actual insurance policy status in real-time through Smart COI technology.

The compliance rate differential tells the story: 60-75% with traditional tracking versus 90%+ with Smart COIs.

The Bottom Line

TrustLayer's AI-powered verification sounds compelling until you realize it can't answer the question that matters most: is your Vendor's coverage actually valid right now? Without real-time policy monitoring, direct carrier verification, or schedule-level tracking, you're managing compliance with annual snapshots that become outdated the moment policies change mid-term.

Among the three alternatives we evaluated, each addresses different needs:

- MyCOI offers basic automation at a lower price point

- Ebix provides enterprise-scale deployment with broader insurance functionality

- Only Certificial eliminates the verification gaps that create actual liability exposure-through Smart COI technology that updates automatically when Agents modify policies, direct AMS integration that prevents fraud at the source, and schedule-level data that confirms specific vehicles and equipment are covered.

Book a free demo of Certificial to see how real-time policy monitoring works in practice and why companies managing high-risk Vendors are achieving compliance rates that static certificate platforms can't match.

Frequently Asked Questions (FAQs)

What are the main reasons companies switch from TrustLayer to alternatives?

Companies leave TrustLayer for three primary reasons. First, unclear fraud detection methodology - TrustLayer claims "AI/ML-powered verification" but provides no transparency on whether it verifies directly with carriers or simply analyzes PDFs, which sophisticated fraud can defeat. Second, no Smart COI technology means TrustLayer operates on static certificates that become outdated when policies change mid-term; if a Vendor's coverage is cancelled in March, TrustLayer won't detect it until the next renewal request in December. Third, no schedule-level data tracking - TrustLayer cannot verify specific vehicles (VINs), equipment (serial numbers), or locations are covered on policies, creating operational risk for transportation, construction, and logistics companies. Organizations prioritizing fraud prevention and real-time policy monitoring find TrustLayer's 65-75% compliance rates insufficient compared to 90%+ rates available with platforms offering Smart COI technology like Certificial.

How does Certificial's Smart COI technology differ from TrustLayer's AI verification?

Smart COI technology connects directly to insurance agency management systems and monitors actual policy data in real-time, not just certificate documents. When policies change (cancellations, limit reductions, endorsement modifications, schedule updates), Smart COIs reflect those changes within seconds of occurrence in the Agent's system. TrustLayer's "AI/ML verification" appears to analyze submitted certificates but lacks real-time connection to source policy data, meaning TrustLayer cannot detect when certificates become outdated after submission. The architectural difference drives compliance outcomes: Certificial achieves 90%+ compliance rates through continuous policy monitoring while TrustLayer achieves estimated 65-75% because static certificates miss mid-term changes. Additionally, Certificial's source verification (only licensed Agents/Brokers can submit) eliminates fraud entirely, while TrustLayer's verification methodology remains unclear.

Is Ebix or MyCOI better than TrustLayer for mid-market companies?

It depends on priorities. MyCOI is better than TrustLayer for budget-conscious mid-market companies ($200-400/month vs. TrustLayer's higher custom pricing) managing straightforward, low-risk Vendor relationships where basic automation meets needs. MyCOI's vendor self-service portal and simple interface provide adequate functionality without paying for TrustLayer's Vendor collaboration features. However, MyCOI has even less fraud protection than TrustLayer (both lack source verification, but MyCOI's verification capabilities are more limited) and lower compliance rates (estimated 60-70% vs. TrustLayer's 65-75%). Ebix is not practical for mid-market - it targets Fortune 500 enterprises with pricing starting mid-five figures and complex implementation timelines. For mid-market companies, the real question is whether budget constraints force MyCOI choice or whether fraud prevention and real-time monitoring justify Certificial investment (similar price point to TrustLayer but 90%+ compliance rates and 100% fraud elimination).

Can TrustLayer detect when a Vendor's insurance policy is cancelled mid-term?

No. TrustLayer operates on certificates submitted through their platform at a point in time. If a Vendor's policy is cancelled days, weeks, or months after certificate submission, TrustLayer has no mechanism to detect that cancellation until someone manually requests an updated certificate or the certificate expires. This creates the "verification gap" that causes most compliance failures - certificates can show valid coverage through December, but if the policy gets cancelled in March, TrustLayer will continue displaying the vendor as compliant for nine months despite zero actual coverage. Smart COI platforms like Certificial solve this by connecting directly to agency management systems and monitoring policy status continuously, capturing cancellations within seconds of occurrence. This fundamental difference explains why TrustLayer achieves estimated 65-75% compliance rates while platforms with Smart COI technology achieve 90%+.

What should I look for when comparing TrustLayer alternatives?

Ask five critical questions. (1) Does the platform verify certificates directly with Insurance Carriers/Agents or accept Vendor-submitted PDFs? Only source verification eliminates fraud risk entirely. (2) Does it offer Smart COI technology with real-time policy monitoring, or does it rely on static certificates that become outdated? This determines whether you'll catch mid-term cancellations and coverage changes. (3) Can it track schedule-level data (specific vehicles, equipment, locations)? Generic coverage confirmation is insufficient for high-risk industries like transportation and construction. (4) What compliance rates does it achieve in documented case studies? Industry average with traditional tracking is 60-70%; Smart COI platforms reach 90%+. (5) What fraud prevention methodology does it use? Look for transparency - vague claims about "AI detection" without methodology details are red flags. Apply these criteria: Certificial is the only platform with source verification, patented Smart COI technology, schedule-level tracking, and proven 90%+ compliance rates. TrustLayer, Ebix, and MyCOI offer varying degrees of automation but all operate on static certificates and cannot provide continuous policy monitoring.

*Certificial research team evaluates COI tracking tools using vendor demos, user feedback, and documented feature tests.

.jpg)

C.svg)